OfferUp scams: 10 common scams and how to avoid them

Online marketplaces make it easy to buy and sell locally, but they also attract their fair share of scammers. You’re never quite sure who’s on the other side of a transaction, especially on platforms like OfferUp, where users aren’t always verified and anyone can create a listing.

With 150+ million downloads and 30 million annual transactions, fraudsters have a huge opportunity to target unsuspecting OfferUp buyers and sellers. From fake listings and overpayment scams to phony shipping invoices and gift card scams, these con artists use a variety of tricks to steal money or personal information.

The good news is you can stay protected if you know what to watch for. In this comprehensive guide, we’ll break down 10 common OfferUp scams. We’ll explain how each works, point out warning signs, and show how to dodge them. You’ll also learn practical safety tips and discover what to do if you get scammed on OfferUp.

Quick tip: Protect your personal information every time you go online.

When you use ExpressVPN, your internet traffic is hidden from prying eyes. If you want to keep your data private during any online transaction or protect your browsing from snoops, ExpressVPN can help. Our VPN encrypts your connection and keeps your personal information safe from anyone trying to spy on your activity.

What is an OfferUp scam?

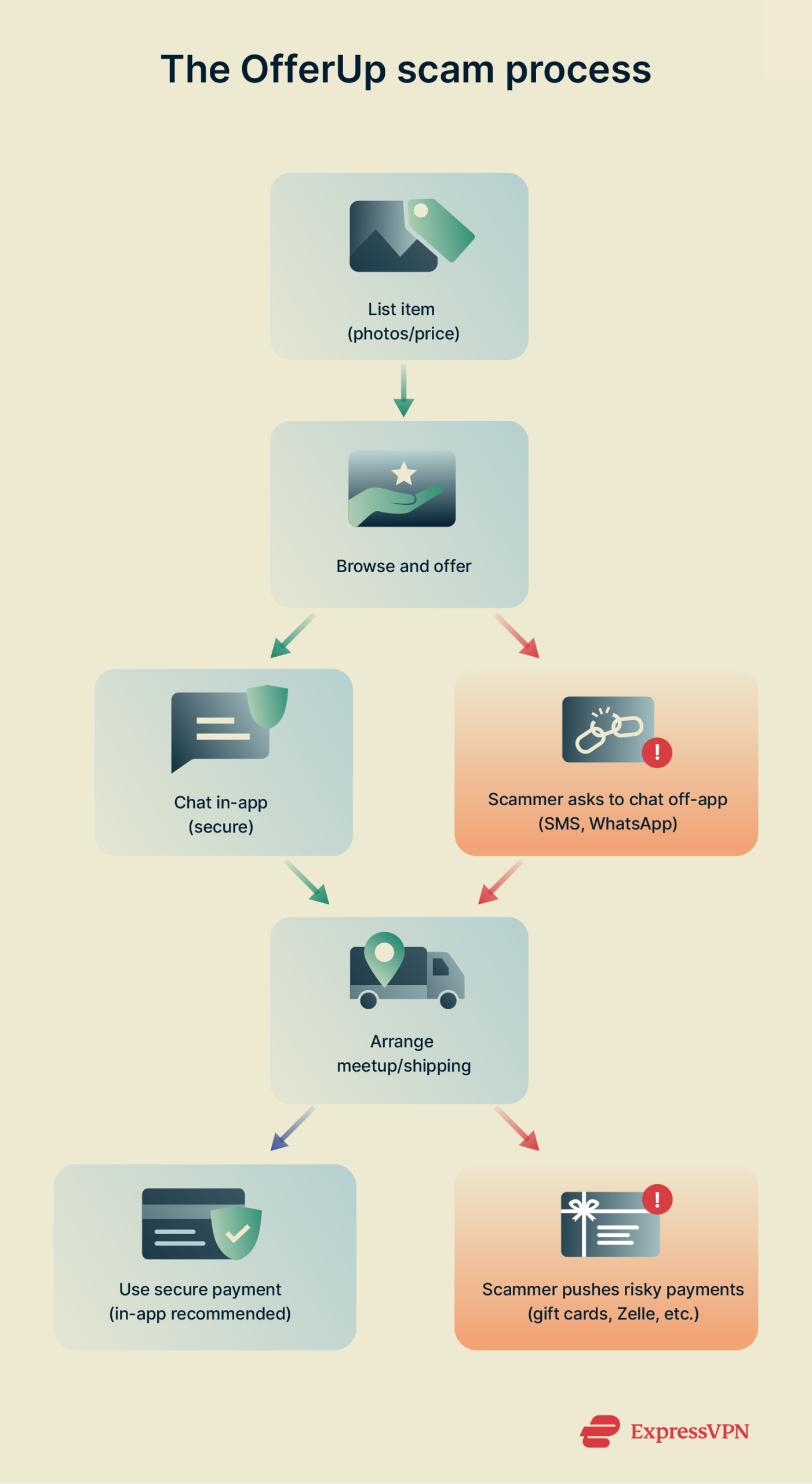

To understand the scam, you first have to understand how OfferUp works. In a nutshell, OfferUp is like a more modern Craigslist: you create a listing with photos and a price, you can chat with interested buyers or sellers through OfferUp’s in-app messaging, and you arrange a meetup or shipment to complete the sale.

OfferUp is generally legit. It offers user ratings, TruYou verification (which confirms identity with a government ID), and secure in-app payments. However, scammers often skirt these safeguards by coaxing you off the platform or pushing risky payment methods. This means the level of safety largely depends on your vigilance.

How do scammers operate on OfferUp?

Scammers use a variety of tactics to trick you.

They create fake profiles with no real history or hijack existing ones. Some use a friendly tone or tell an emotional story. Others post offers that are too good to be true.

Once they’ve got your attention, they ask you to leave OfferUp’s messaging system, claiming it’s easier to talk over text or email. That’s a red flag; con artists do this to avoid OfferUp’s protections.

Some will request personal info for “verification purposes” or insist you send money outside the app using gift cards or wire transfers. Others set up fake OfferUp lookalike websites to steal your login details or credit card information.

And these techniques aren’t restricted to OfferUp; read our full guide on how to stay safe when shopping online.

How transactions work on OfferUp

OfferUp transactions are simple:

- A buyer finds an item on the OfferUp website or app.

- The buyer messages the seller in-app for details or to negotiate a price.

- They agree on a meetup location or choose to ship the item.

- For local deals, payment is usually cash in person. For shipped items, OfferUp’s in-app payment system is the safest option.

- After the purchase, the buyer and seller can leave feedback on one another.

OfferUp’s built-in processes help protect against payment fraud. The moment you step outside those steps, like clicking a random link or switching to email or text, the risk of getting scammed goes way up.

Is OfferUp safe to use?

OfferUp is a recognized name with many successful deals happening every day, but no marketplace is immune to internet fraud. That’s why OfferUp has built-in safety features designed to protect buyers and sellers.

OfferUp’s safety features

- Verified user badges: Users can confirm their identity by sharing a form of ID, which helps others know they’re dealing with a real person.

- Rating system: Buyers and sellers can rate each other after a transaction, helping others see whether someone has a decent track record.

- In-app messaging: OfferUp encourages communication within the platform, so there’s no need to share your email, phone number, or other personal info.

- Payment protection: OfferUp has a 2-day purchase protection policy for shipped items, so if something goes wrong, you can file a claim.

- Reporting features: OfferUp lets you flag suspicious profiles or listings, which can lead to account removal.

Common risks when using OfferUp

Even with these safeguards, OfferUp still involves some risk, whether you’re a buyer or a seller.

Buyer vs. seller risks: Who is more vulnerable?

Both sides face unique threats. Buyers can be tricked by low prices, nonexistent products, or phishing scams that lure them off-platform. They’re often asked to use nonstandard payment methods or click suspicious links, which can lead to stolen information or lost funds.

Meanwhile, sellers are at risk of overpayment schemes (where “buyers” send bad checks and demand partial refunds), fraudulent credit card payments, or even physical danger if they meet someone in an isolated area.

And both sides can experience aggressive, pushy behavior. Scammers often try to rush the deal, saying things like “I have another buyer who’s ready to pay right now” or bombarding you with messages. Some may also threaten negative feedback if you don’t comply.

In these situations, slow things down. Scammers rely on urgency; legitimate buyers and sellers understand the need for caution. And if someone crosses the line, don’t hesitate to block or report them.

10 common OfferUp scams and how to spot them

Scammers exploit emotions. They count on desperation or excitement from unsuspecting buyers and sellers. Recognizing their tactics is your best defense. Here are 10 common ways criminals trick people on OfferUp.

1. Fake OfferUp websites (phishing scams)

How scammers trick users with fake sites

Scammers often send links to fake OfferUp websites or third-party payment sites. You might be chatting with a “buyer” or “seller” who suddenly asks you to click a link, claiming it’s to complete the sale or view a better deal.

The link leads to a spoofed website that looks nearly identical to OfferUp, complete with familiar colors, logos, and layout. You may not notice anything unusual: some fake URLs even look convincing, like “offeruup.com.”

If you log in or enter payment info on this fake site, scammers can steal your info. In some cases, these sites also trigger malware downloads. If you land on a suspicious page, close it immediately and report the sender if possible. You can also block the site.

How to verify you’re on the real OfferUp

- Check the URL: The official URL is offerup.com. You can also use the official app.

- Don’t click unrequested links: If someone sends a suspicious link, don’t open it. Instead, go directly to OfferUp through your browser or app.

- Look for secured HTTPS: A secure site should have “https://” and a padlock in the address bar, but keep in mind that scammers can sometimes fake this, too.

- Use the official app: Only download OfferUp from trusted app stores like the App Store or Google Play.

2. Overpayment scams

How this scam works

A buyer might say they accidentally sent you a payment for more than the agreed price and ask you to return the extra amount. The catch? Their original payment either bounces or turns out to be made with a stolen check or fake funds.

For instance, you list a $200 camera. The buyer says they “mistakenly” sent $300 and urges you to refund $100. Once you send it, you discover their payment was fraudulent. They get your camera plus that extra $100, and you’re left with nothing.

Signs you’re being scammed

- The buyer claims they “only have a check for more than the asking price.”

- They want you to send the refund using a gift card or cash app.

- They refuse to use OfferUp’s integrated payment system.

- They have no or low ratings on the platform.

- The conversation feels rushed or pushy.

If someone offers to pay above your item price, be cautious. Wait until the payment is confirmed, especially if it’s a check. Better yet, refuse any request to use alternative payment methods.

3. Fake verification code requests

A buyer or seller might say something like, “I need to send you a code to confirm you’re real,” or claim it’s required for fraud prevention. Then, you get a text or call with a verification code, usually tied to your phone number or online accounts.

A buyer or seller might say something like, “I need to send you a code to confirm you’re real,” or claim it’s required for fraud prevention. Then, you get a text or call with a verification code, usually tied to your phone number or online accounts.

If you share that code, you may be handing them access to your accounts or phone number. Scammers can then impersonate you, carry out more phishing attacks, or use your identity in other schemes. Remember: OfferUp never requires any kind of code exchange outside the app. If someone asks, it’s a scam.

Pro Tip: If you’ve shared a code or suspect a breach, use ExpressVPN's ID Alerts to check if your personal info has appeared on the dark web. Combined with a VPN, this gives you a powerful way to stay on top of account security.

4. Empty box scam

The “empty box” scam is a cruel bait-and-switch that targets buyers purchasing items to be shipped. You pay through the app, and the seller ships a box, but it’s empty. They might even provide a real tracking number. You see “delivered” on the shipping updates. Then you open it and find… nothing.

The scammer relies on buyers not reading the description closely. They bury a line like “(box only)” or “photo for collector” deep in a long product description, hinting that you’re buying packaging or a picture, not the actual item. After the sale, they vanish, delete their profile, or deny responsibility.

How to avoid it:

- Read listings carefully. Look for words like “box only,” “display model,” or “empty packaging.”

- Ask for clear photos of the actual product, not just the box.

- Check the seller’s ratings and feedback.

- Use OfferUp’s shipping option to get 2-day purchase protection in case something goes wrong.

5. Counterfeit products and “too good to be true” offers

Fake items are a persistent issue on online marketplaces. That’s not surprising when you consider the global counterfeit goods industry is worth over $2 trillion. On OfferUp, you might see high-end products or collectibles priced below the standard market value. The catch? You could end up with a cheap knockoff.

Common fake items sold on OfferUp

- Luxury purses and wallets (often “designer” brand names).

- Popular wireless earbuds or headphones.

- Top-brand sneakers, sports shoes, or fashion brands.

- Smartphones marketed as the latest models

- Limited-edition sports jerseys or special event memorabilia.

Fake listings often include vague descriptions and stock images. If something feels off, ask the seller for more photos, especially close-ups of serial numbers, logos, or packaging. And when the price tag is high, consider meeting in person to inspect the item before handing over any money.

How to spot counterfeit listings

- The price is far below market value for a high-end brand.

- Photos look like generic stock images.

- The seller avoids questions about authenticity or proof of purchase.

- The description is vague and generic.

- The same listing appears under multiple accounts

“Too good to be true” deals, like a new laptop for half its retail price, are also common. A scammer might count on your excitement, hoping you’ll pay instantly to secure the “steal” and ignore warning signs. Be cautious with eye-popping discounts, especially during busy shopping seasons, when scammers love to hype fake “limited-time” deals.

6. Fake accounts with multiple similar listings

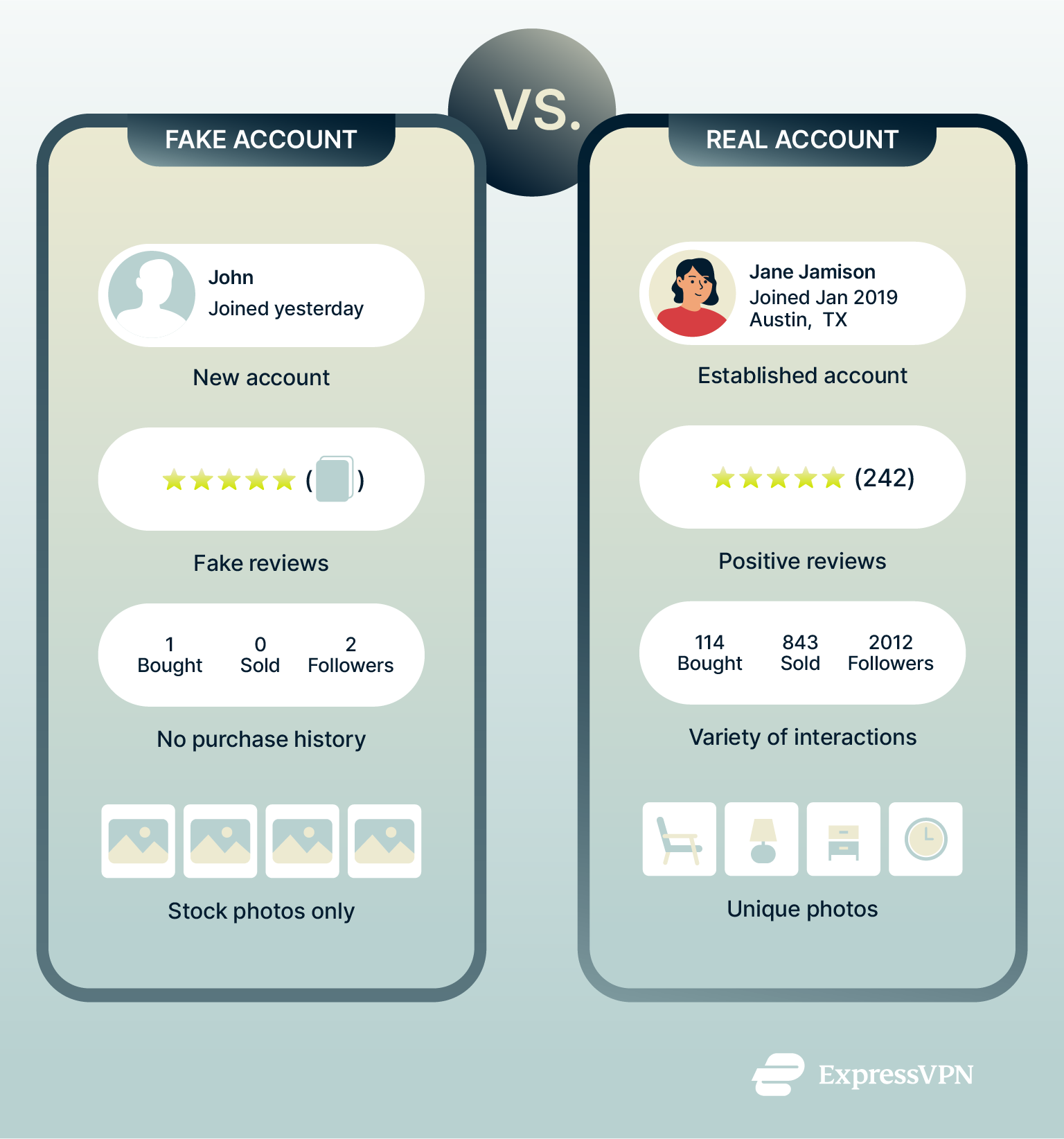

Scammers often create fake profiles on OfferUp and flood them with listings, often with the same images or descriptions. These are “burner” accounts, made just for scamming. This is often used for high-demand items like new gaming consoles, phones, or designer goods.

Scammers often create fake profiles on OfferUp and flood them with listings, often with the same images or descriptions. These are “burner” accounts, made just for scamming. This is often used for high-demand items like new gaming consoles, phones, or designer goods.

The listings advertise irresistible deals, take the buyer’s money, and then disappear without a trace.

How to identify suspicious sellers

- No purchase or sales history: The account was created last week but lists 10 brand-new, pricey electronics.

- Stock images: All the product photos look overly professional or generic.

- Repetitive postings: The same appears multiple times under one account.

- Few or suspicious ratings: Either there are none, or the reviews all sound copy-pasted.

How to verify a seller’s reputation

- Check the account creation date: A new seller isn’t always suspicious, but if it’s new and full of listings, be wary.

- Look at reviews and stars: Are there real interactions, or do the reviews seem fake?

- Check for the TruYou verification badge: This shows the user verified their ID with OfferUp.

- Do a reverse image search: This can reveal if photos were stolen from other sites.

7. Buyers/sellers who claim to be “out of the country”

“I’m overseas now but need to sell my car back home,” or “I’m deployed, so I need to do a quick sale.” These lines might tug at your emotions, but they’re often part of a scam. They can’t meet face-to-face and will pressure you to pay upfront. Once you send the money, the item never arrives.

They might also say a friend or delivery service will handle the exchange for them. They’ll push you to wire funds or pay using unprotected methods, like gift cards. Once that money is gone, so are they.

If someone says they’re abroad, treat it as a major red flag and don’t move forward with the deal.

8. Shipping fee scams

OfferUp has a built-in shipping system that offers some purchase protection. Because of this, scammers often concoct fake shipping arrangements to get you outside the platform. For example, a seller might claim they’ll use FedEx or UPS and send you a fake invoice that looks like it’s from the shipping company, requesting additional payment.

Sellers can be targeted, too. A buyer might ask you to use a different shipping method and then send a fake payment receipt, hoping you’ll ship the item without confirming payment.

In either case, the scammer’s goal is to get you to pay extra fees or send an item without ever receiving real money.

How to protect yourself:

- Only pay for shipping through OfferUp’s official shipping label.

- Don’t send money outside the platform for “shipping fees”

- If a seller demands extra payment after you’ve already paid, don’t send it, as it’s likely a scam.

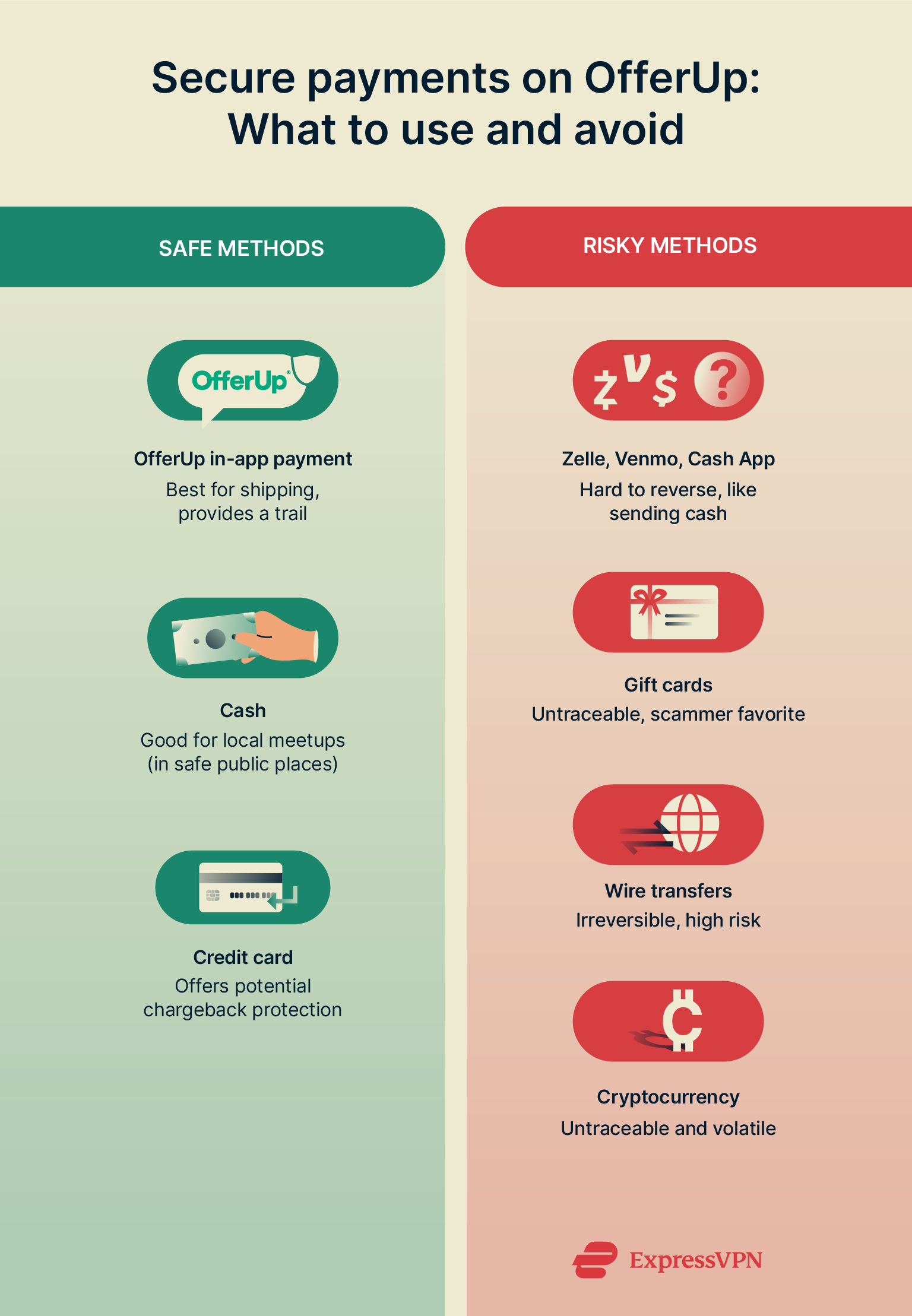

9. Alternative payment method scams

Scammers want to avoid OfferUp’s payment system because it offers some purchase protection. They might say they can’t use the app because it’s “frozen” or claim a payment won’t go through. If you’re meeting in person, a buyer might say they’ve hit a daily cash withdrawal limit. Then they’ll push you to accept payment through apps like Venmo, direct transfers, or checks that won’t clear.

Scammers want to avoid OfferUp’s payment system because it offers some purchase protection. They might say they can’t use the app because it’s “frozen” or claim a payment won’t go through. If you’re meeting in person, a buyer might say they’ve hit a daily cash withdrawal limit. Then they’ll push you to accept payment through apps like Venmo, direct transfers, or checks that won’t clear.

Why scammers avoid OfferUp payments

- Suspicious transfers are easier to detect within OfferUp’s system

- There's a digital trail if you pay or receive funds through the app.

- Chargebacks are easier through official payment channels

- Gift cards are untraceable once redeemed

Safe payment methods to use

- OfferUp’s in-app payment: Good for shipped items.

- Cash: Safe for in-person deals if done in a public place.

- Credit card: Offers added protection through chargebacks.

In general, when you’re shopping online, always use secure payment tools.

10. Fake customer support scams

How scammers impersonate OfferUp support

A scammer might reach out pretending to be from OfferUp’s support team. They’ll say your account has an issue or that you need to verify payment details and then send you a link to a fake site where you’re asked to enter your login or credit card information.

You might also come across a listing that says, “Need OfferUp to fix an issue? Contact this special helpline.” That “helpline” is a scam. The person on the other end may try to trick you into installing remote-access software or demand a “processing fee” for fake support.

Official ways to contact OfferUp

Only contact OfferUp through official channels: either in the app or via the “Contact Us” section on offerup.com. And remember: Real OfferUp staff will never ask for your password, verification code, or payment information.

How to avoid getting scammed on OfferUp

Each scam has its own warning signs, but these universal tips can help both buyers and sellers stay safer on OfferUp.

Each scam has its own warning signs, but these universal tips can help both buyers and sellers stay safer on OfferUp.

Tips for buyers to stay safe

- Stick to in-app messaging: If someone wants to move to email or text right away, be cautious.

- Inspect items in person: If possible, see the item before paying.

- Use safe payment methods: OfferUp’s built-in payment system or cash in person are the safest options.

- Compare prices: Below market prices might hint that something’s not right.

- Research the seller: Check the seller’s profile, ratings, and history before agreeing to a deal.

- Avoid sharing personal data: Don’t give out your full name, phone number, or address unless it’s absolutely necessary for shipping.

Tips for sellers to avoid scammers

- Stay on OfferUp’s system: It gives you a record of the conversation.

- Wait for payment clearance: Don’t ship the item until you’re sure the payment is valid.

- Beware of checks and overpayments: If a buyer “accidentally” overpays, that’s a big red flag.

- Document items: Take photos, note serial numbers, and keep proof in case you need it.

- Meet in public: If it’s a local handoff, find a place with foot traffic or even near a police station if your area allows it.

- Be skeptical of long-distance excuses: If the buyer claims to be out of town and can’t meet, proceed with caution.

The importance of meeting in safe locations

Local deals often mean meeting face-to-face. That’s fine, but it’s best to meet in:

- Public spaces: Well-lit store parking lots, busy cafés, or mall entrances.

- Safe exchange zones: Some communities set up monitored areas specifically for these meetups, often near police stations.

- Daytime: If possible, meet in broad daylight.

- With a friend: A second person adds extra safety (and sometimes a second opinion).

If someone refuses to meet in a public or safe location, consider it a red flag and walk away.

Why you should never share personal information

Some scammers aren’t just after your money; they’re after your identity. They may ask for your bank info, email address, or phone number for “verification” or “shipping updates.” Don’t fall for it. That’s not how OfferUp works.

Remember:

- Never give your Social Security Number: Nobody on OfferUp will ever need it.

- Guard your address: Only provide your home address if you fully trust the other party.

- Don’t share codes: As mentioned earlier, never reveal verification codes.

What to do if you get scammed on OfferUp

Mistakes can happen, so here’s what to do if you’ve been scammed on OfferUp.

Reporting a scam to OfferUp

-

- Gather evidence: Save screenshots of messages, the listing, or anything else relevant.

- Use the ‘Report’ feature: In the app, find the user’s profile or the item listing and report suspicious behavior.

- Contact OfferUp support: Explain your case. They might ask for the conversation history.

- Freeze your credit: If personal info was exposed, freeze your credit with the major bureaus to prevent identity theft. Also consider enabling fraud alerts.

- Change your OfferUp password: Change your OfferUp password immediately if you think your account was compromised. Also update any other accounts that use the same credentials.

- Warn others: If possible, leave an honest rating that alerts the community.

Contacting law enforcement

If you’ve lost money or your safety was threatened:

- File a police report: Bring evidence, including the user’s profile, chat logs, payment details, and any personal info they provided. Note that your bank or insurer might require a police report if you plan to dispute charges.

- Notify federal agencies: The Federal Trade Commission (FTC) or the Internet Crime Complaint Center (IC3) can record your case.

- Keep records: Keep a copy of everything you submit, including reports, emails, and receipts.

Dispute payments and recover your money

When you want to dispute a transaction, the process varies depending on your payment method.

- OfferUp’s in-app payments: Contact OfferUp immediately to see if you can pause or reverse the transaction.

- Credit card: Call your credit card company immediately and request a chargeback. They may investigate on your behalf.

- Bank transfers: Contact your bank immediately. Some transfers can be reversed if caught early.

- Cash: Unfortunately, cash is nearly impossible to recover once exchanged.

- Gift cards or cryptocurrency: These are extremely difficult to trace or retrieve, which is why scammers love them.

Remember: Timing is everything. The sooner you act, whether it’s contacting your bank, card provider, or OfferUp, the better your chances of recovering lost funds.

If a scam caused you significant financial losses, you could also consider using the small claims court. This might require you to know the scammer’s true identity and location.

Regardless of the outcome, it’s wise to explore steps to protect yourself going forward. Watch for suspicious behavior, use secure payment channels, and consider using a VPN to safeguard your browsing.

If your personal data may have been compromised, identity theft protection services can help monitor for suspicious activity and alert you to potential fraud.

Pro tip: ExpressVPN's Identity Defender Suite includes tools like Credit Scanner and ID Alerts to help detect the misuse of your information. The included ID Theft Insurance offers additional support for recovery.

FAQ: Common questions about OfferUp scams

Will OfferUp refund me if I get scammed?

Is it safe to give out my phone number on OfferUp?

How to spot a scammer on OfferUp (buyers & sellers)?

- Requests to move the conversation off OfferUp.

- Overpayment attempts or demands for non-standard payment methods.

- Incomplete or suspicious-looking profiles.

- Short, vague listings, especially with prices that seem too good to be true.

- Pressure to act immediately.

If something feels off, trust your instincts. No deal is worth the risk, and there’s always another one around the corner.

What payment methods are safest on OfferUp?

- OfferUp’s built-in payment system: Good for shipped items, with some purchase protection.

- Cash in a public place: Fine for local deals, just be mindful of safety when carrying cash.

- Credit card: Allows you to file a chargeback if you’re scammed

Can OfferUp ban scammers?

Can OfferUp be trusted?

How to avoid being scammed on OfferUp?

- Use the app’s messaging system and avoid clicking on external links.

- Check user reviews, ratings, and whether they have a verified badge.

- Inspect items in person before paying.

- Be cautious of “out of the country” excuses or prices that seem too good to be true

- Never share personal details like verification codes.

- Pay through OfferUp or in cash at a safe location.

Should I report OfferUp scams to the police?

Can I take legal action against an OfferUp scammer?

What should I do if I accidentally paid outside OfferUp?

- Contact your payment provider (bank or app) to see if you can reverse the charge.

- Inform OfferUp by reporting the user.

- File a complaint with agencies like the Federal Trade Commission (FTC) or local police if needed.

- Keep all conversations, screenshots, and receipts.

What are the safest places to meet an OfferUp buyer or seller?

- Police station parking lots.

- Busy coffee shops or mall food courts.

- Bank lobbies (for large cash transactions).

- Grocery store lots with security cameras.

How do I report a scammer on OfferUp?

For additional help, you can also visit OfferUp’s online Help Center to contact their support team. Be sure to include documentation, like screenshots, payment receipts, and chat logs, to support your case and help them investigate.

Take the first step to protect yourself online. Try ExpressVPN risk-free.

Get ExpressVPN